Our Two Cents: FD Alternatives

An end-to-end explainer on investment options available at a bank

A quick introduction before we begin: You will hear from us every Monday and Friday at 9 am on the dot. The newsletter has 2 segments- one covers all things personal finance and the other is a miscellaneous (read: chaotic) college-related collective. Monday’s newsletter, titled ‘Our two cents’, is dedicated to personal finance and this is where we divulge our college-centric take on the subject of saving, budgeting, investing, and the like. Friday’s newsletter, titled ‘In other news’, covers just about everything else- from research papers to student loans to so much more. And with that out of the way….

Hi there! Top of the morning to you. It’s that time of the week again. In today’s edition, we talk about safer investment options besides fixed deposits. Without further ado, let’s dive into it.

📨 A little context

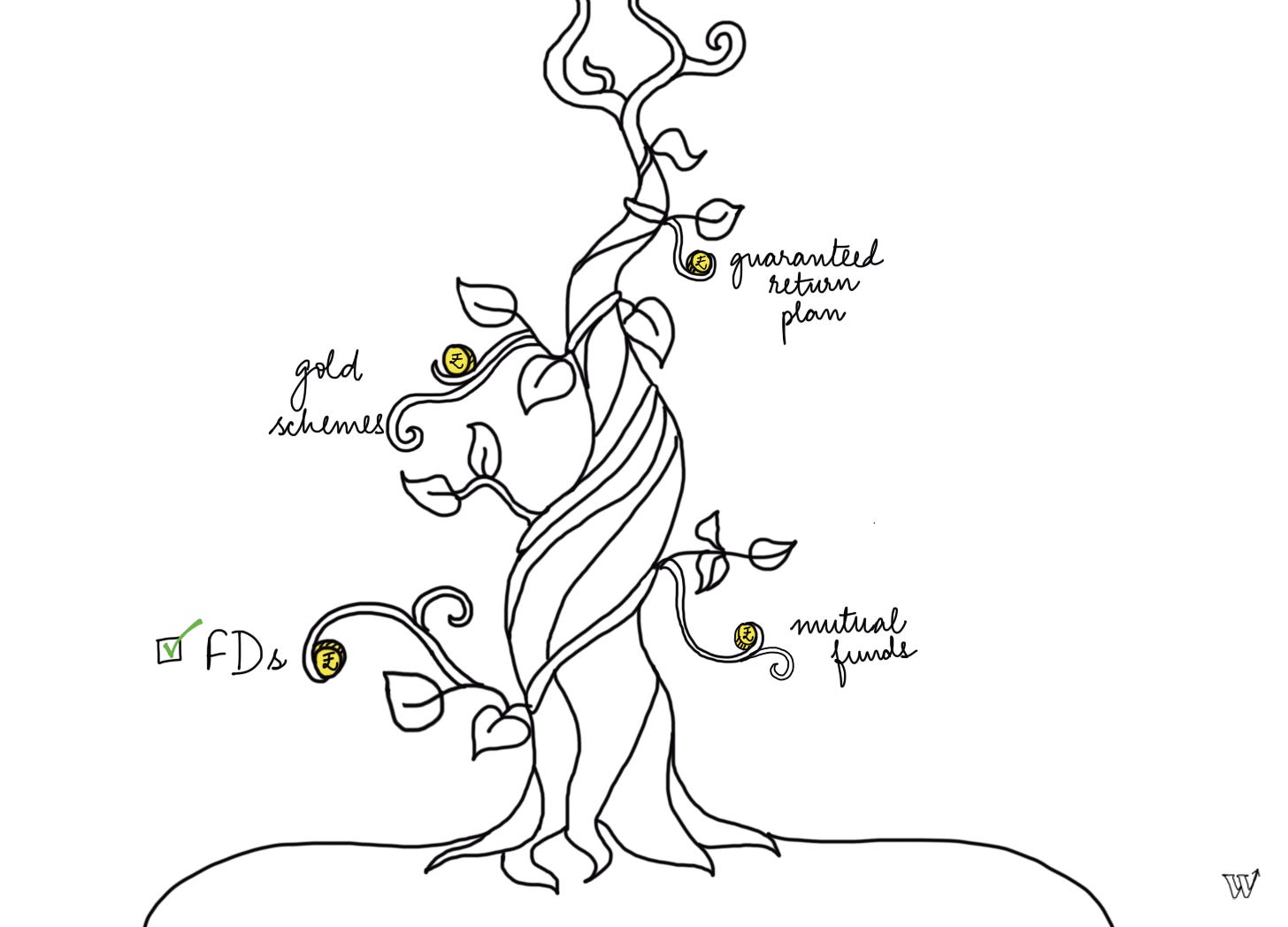

A couple of days back we wrote about fixed deposits and how this could be an ideal time to invest in them. Fixed deposits come with the benefits of guaranteed returns but more often than not these returns are not that attractive. Thus, people tend to shift to mutual funds. But markets are volatile and not everyone likes the risk that comes with investing in stocks. So, today we are going to talk about a few investment opportunities that banks offer for better returns than FDs and for lesser risk than MFs.

🔍 The focus

Guaranteed plan

A Guaranteed Return Plan (GRP) is a type of investment plan offered by banks in India, which provides a fixed and guaranteed return on investment at maturity. Under this plan, you can invest a lump sum amount for a fixed period of time, and the bank promises to pay a fixed return on the investment, irrespective of market fluctuations.

Guaranteed plans give the best of both worlds:

Higher return than FDs

Flexibility and customization in fixing the premium amount and policy term

Financial security of your loved ones in case of unfortunate demise

Premium paid is eligible for tax benefits under section 80C

There are a lot of policies available out there. If you visit your bank, they’ll be able to help you customize the plan as per your needs.

But for today, let’s look at a few cases to get an understanding of how GRP works. Source for these cases: Bajaj Allianz Life - Assured Wealth Goal

How to decide the plan:

> Step 1: Select from any of the six variants

> Step 2: Decide the premium amount and for how long you wish to pay

> Step 3: Choose Deferment Period and when to start receiving the income

> Step 4: Choose how long you want to receive the income

The policy could have multiple variants and each of them would have multiple features. But the essence remains the same - provide guaranteed returns.

Let’s look at two of these variants:

Lifelong Income

Ram is a 51 year old Professor and he will retire at age of 63 years. Post his retirement, he needs a guaranteed regular flow of income to take care of daily requirements of himself and his wife.

He invests in Bajaj Allianz Life Assured Wealth Goal by paying `1,00,000 p.a. for 10 years.

Ram pays: Rs 1,00,000 p.a for 10 years

Ram receives: Rs 1,02,000 p.a for 37 years + Rs 10,00,000 at the end of maturity

Total premium: Rs 10,00,000

Total benefit: Rs 47,74,000

If the policyholder dies before the maturity of the policy, then they will receive a death benefit decided before finalising the policy.

Wealth Creation

Rajesh, a 30-year-old engineer has a 5-year-old son. Rajesh aspires to plan for his child's higher education. He purchases Bajaj Allianz Life Assured Wealth Goal on his life and pays `1,50,000 p.a. for 8 years with an aim of creating a corpus after few years.

Rajesh pays: Rs 1,50,000 for 8 years

Rajesh receives: Rs 21,39,000 paid as a lump sum at the end of 15 years

Total premium: Rs 12,00,000

Total benefit: Rs 21,39,000

If the policyholder dies before the maturity of the policy, then they will receive a death benefit decided before finalising the policy.

In a nutshell, these policies are a good way to secure your family from any mishaps and build a long-term stream of income for yourself without any inherent risks.

Gold deposit scheme:

This scheme is helpful for anyone who is trying to put their idle gold into productive use. If you have a lot of idle gold then you can deposit that with banks and earn interest on it. You could earn up to 2.5% p.a interest on the deposits and the interest earned under this scheme is entirely tax-free. The minimum requirement for this scheme is 10 grams with no maximum limit.

Regular mutual funds

If you invest in a mutual fund through a bank, it is called a regular mutual fund whereas if you do it directly, it’s referred to as a direct mutual fund. Regular mutual funds charge higher commissions since your investment is being routed through the bank. It is usually suggested that a smart investor should invest in a direct mutual fund to avoid paying more money. However, regular mutual funds come with the benefit of having some guidance on where to invest and when. If you invest in mutual funds through banks, they could help you decide which fund would be more suitable for your financial needs and they could also help you rebalance your investments in future if the need arises. So, if you think you need help making the right decision then you could opt for a regular mutual fund.

These are a few options available at a bank besides fixed deposits. If you need more information on any particular investment avenue, you could drop by a bank branch and enquire about it or feel free to send in your questions through our feedback form and we would love to get back to you.

👋🏻 Bye-bye

………Aaand that’s a wrap. See you Friday :) Of course, we can correspond earlier if you have feedback or a topic you want us to cover. Feel free to use the comment section or write to us at witmeup.in@gmail.com. Alternatively, you can anonymously provide your valuable feedback here. Thanks, and toodles!