A quick introduction before we begin: You will hear from us on the 15th and 30th of every month at 9 am on the dot. The newsletter has 2 segments- one documents the lives of young working professionals and the other is a miscellaneous (read: chaotic) college-related collective. The newsletter for 15th, titled ‘’Our Two Cents” will cover our corporate journey and insights as we become financially independent. The newsletter for 30th, titled ‘In other news’, covers college-centric views on personal finance, research papers, student loans, and so much more. And with that out of the way…

Hi there! Top of the morning to you. In today’s edition, we talk about gold as an investment option.

📨 A little context

Gold – a time-tested treasure of the past but an overlooked investment option today. In the age of digital assets, we are reminded of gold only on 3 occasions – Akshaya Tritiya, Dhanteras and Weddings. This too only applies to the millennials!

In our dynamically changing world where ‘oil’ and ‘data’ are considered the new gold, are old school gold investments still relevant?

As Gen-Z investors enter the realm of investing, it’s important for us to understand the advantages of gold in order to make informed decisions about incorporating this precious metal into our investment strategies. This newsletter is your trusted guide to navigate the captivating world of gold investing.

🔍 The focus

All that Glitters is Gold: Why Is Gold Considered a Safe Investment?

Gold has always been one of the most preferred investments in India. Let’s look into what makes it a compelling investment option:

Safe Haven: Gold is not used as a currency today, but its role as money makes it superior to any currency. People see gold as a way to pass on and preserve their wealth from one generation to the next. Gold fulfils the promise to serve as a long-term store of value better than any currency.

Hedge Against Inflation: The hedge against inflation is the traditional motive behind the investment in gold. When inflation rises, the value of the currency goes down. Over the long-term, almost all major currencies have depreciated in value relative to gold. Likewise, the annualized return of gold over ten years has been way higher than that of inflation.

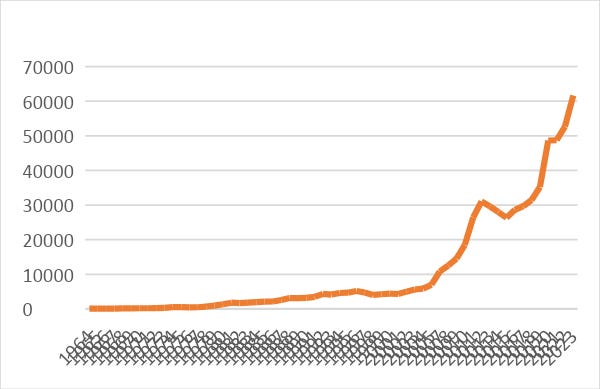

In the past 50 years, gold has appreciated by over 300% and has gone from Rs. 184 in 1970 to Rs. 59395 in 2023 with CAGR of 11.5% for the 53-year period.

High Liquidity: Gold is highly liquid. Virtually any jewelery dealer in the world will recognize gold and buy it from you. You can sell it to your local coin shop, a pawn shop, a private party, or an online dealer. It can always be sold for cash or traded for goods or put up as collateral for a loan.

No Specialized Knowledge: Unlike stocks, bonds, cryptocurrencies, real estates, among a series of other investments, gold requires no specialized skills. There are no tedious charts to compare all day long, or trading bots to trust with your investments. As an investor, all you need to do is simply buy and store your gold.

Gold Rush 2.0: If gold is such a great asset, then why should you not have a gold portfolio alone?

The real answer lies in the numbers.

Let’s compare the average returns offered by gold over the last three decades. For the sake of an example, let’s assume that you had invested Rs.50000 in gold and Rs.50000 in Rs.50000 in in 1990. Gold would be around Rs.2.5 lakh. Today, the equity investment would have been worth around Rs.4 lakh. So, equity has offered better returns over time despite the volatility and market crashes.

24K Magic: Does It Make Sense for Young Professionals/College Students to Invest in Gold?

Two Words: Portfolio Diversification.

As we step into the world of investing, we are enthralled by risky assets— Equity stocks, Crypto, Futures and Options. Pretty exciting stuff. Everything is great when the portfolio is in the green. But the real panic sets in when the portfolio turns red. Suddenly, in a few days, you are down 80%. Remember March 2020?

Gold to the rescue!

Gold has historically been perceived as a safe-haven asset during times of economic uncertainty, market downturns, or geopolitical tensions. Gold often exhibits a low or negative correlation with other asset classes such as stocks, bonds, and real estate. When the value of one asset class is declining, gold may hold or even increase in value. Investors often flock to gold as a store of value and a hedge against inflation and currency fluctuations. Its price tends to rise during periods of market turmoil, offsetting potential losses in other investments.

The Midas Method: What are the best ways to invest in gold?

Conventionally, it is just buying physical gold in the forms of jewelry, coins, bullions, or artifacts. But gone are the days where everyone had a special vault in the house loaded with gold bars.

Now there are new methods to reap the benefits of gold without owning it:

Gold ETFs: Gold ETFs are investment funds that own physical gold and issue shares that represent fractional ownership of the underlying gold. These ETFs trade on stock exchanges, allowing investors to gain exposure to gold's price movements without directly owning or storing physical gold.

Digital Gold: Digital gold refers to a digital representation or form of gold that allows individuals to invest in or trade gold electronically without physically owning the metal. It is a digital asset that represents ownership or exposure to the value of gold.

Gold Mutual Funds: Gold funds are a type of mutual funds that directly or indirectly invest in gold reserves. Investments are usually made on stocks of gold producing and distributing syndicates, physical gold, and on stocks of gold mining companies.

Sovereign Gold Bonds: Sovereign Gold Bonds are the safest way to buy digital Gold as they are issued by the Reserve Bank of India on behalf of the Government of India with an assured interest of 2.50% per annum. The bonds are denominated in units of grams of gold with a basic unit of 1 gram.

Golden Rules: What Factors to Consider Before Investing in Gold?

Other than knowing your investment goals and portfolio allocations, some factors to consider are:

Investment Horizon: Gold can be a long-term investment, but short-term fluctuations in price should not deter you if you have a longer investment horizon.

Cost Considerations: Understand the costs associated with gold investments. These may include purchase premiums, storage fees (if investing in physical gold), management fees (for ETFs or mutual funds), or brokerage fees (for buying stocks or futures). Evaluate these costs and consider their impact on your overall investment returns.

Timing: Study historical trends, current market conditions, and factors that influence gold prices such as economic indicators, geopolitical events, and monetary policies. Timing is everything. Gold rates dipped to Rs. 46,000 in 2021 and have soared to Rs. 62000 in 2023.

Bling It On: How Much of Your Portfolio Should You Invest in Gold?

There is no one size fits all answer here.

First things first, you must design your investment portfolio in a manner that enables you to achieve your long-term financial goals. While many experts believe that investors should limit around 10-15 per cent of their investment portfolio to gold investments, there are many factors to consider before making that decision. It is vital to keep check of the macroeconomic and microeconomic events, look at the risk-return balance of your portfolio and rebalance it to suit your preferences.

👋🏻 Bye-bye

………Aaand that’s a wrap. See you on 15th :) Of course, we can correspond earlier if you have feedback or have a couple other topics you’d like for us to cover in the coming editions. Feel free to use the comment section or write to us at witmeup.in@gmail.com. Alternatively, you can anonymously provide your valuable feedback here. Thanks, and toodles!